Wednesday, February 27, 2008

Wednesday, March 21, 2007

How taxes work!

If they paid their bill the way we pay our taxes, it would go something like this:

The first four men (the poorest) would pay nothing.

The fifth would pay $1.

The sixth would pay $3.

The seventh would pay $7.

The eighth would pay $12.

The ninth would pay $18.

The tenth man (the richest) would pay $59.

So, that's what they decided to do.

The ten men drank in the bar every day and seemed quite happy with the arrangement, until on day, the owner threw them a curve.

"Since you are all such good customers," he said, "I'm going to reduce the cost of your daily beer by $20."Drinks for the ten now cost just $80.

The group still wanted to pay their bill the way we pay our taxes so the first four men were unaffected. They would still drink for free. But what about the other six men - the paying customers? How could they divide the $20 windfall so that everyone would get his 'fair share?'

They realized that $20 divided by six is $3.33. But if they subtracted that from everybody's share, then the fifth man and the sixth man would each end up being paid to drink his beer.

So, the bar owner suggested that it would be fair to reduce each man's bill by roughly the same amount, and he proceeded to work out the amounts each should pay.

And so:

The fifth man, like the first four, now paid nothing (100% savings).

The sixth now paid $2 instead of $3 (33%savings).

The seventh now pay $5 instead of $7 (28%savings).

The eighth now paid $9 instead of $12 (25% savings).

The ninth now paid $14 instead of $18 (22% savings).

The tenth now paid $49 instead of $59 (16% savings).

Each of the six was better off than before. And the first four continued to drink for free. But once outside the restaurant, the men began to compare their savings.

"I only got a dollar out of the $20,"declared the sixth man. He pointed to the tenth man," but he got $10!"

"Yeah, that's right," exclaimed the fifth man. "I only saved a dollar, too. It's unfair that he got TEN times more than I!"

"That's true!!" shouted the seventh man. "Why should he get $10 back when I got only two? The wealthy get all the breaks!"

"Wait a minute," yelled the first four men in unison. "We didn't get anything at all. The system exploits the poor!"

The nine men surrounded the tenth and beat him up.

The next night the tenth man didn't show up for drinks, so the nine sat down and had beers without him. But when it came time to pay the bill, they discovered something important. They didn't have enough money between all of them for even half of the bill!

And that, boys and girls, journalists and college professors, is how our tax system works. The people who pay the highest taxes get the most benefit from a tax reduction. Tax them too much, attack them for being wealthy, and they just may not show up anymore. In fact, they might start drinking overseas where the atmosphere is somewhat friendlier.

David R. Kamerschen, Ph.D.

Professor of Economics

For those who understand, no explanation is needed. For those who do not understand, no explanation is possible

Tuesday, September 12, 2006

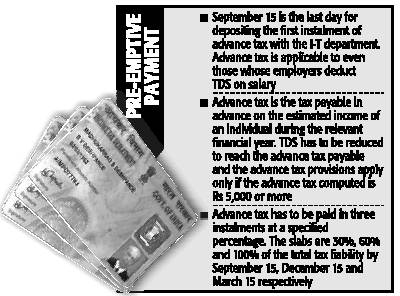

Finance | Income Tax | Beware taxpayers: Ides of September cometh

Courtesy: The Economic Times, Bangalore : September 12, 2006: available at Beware taxpayers: Ides of September cometh

Tuesday, February 28, 2006

Finance | Budget 2006| Income Tax

(one-by-six scheme refers to the six conditions such as credit card, foreign travel etc -if you satisfy even one of these conditions you have to fill your IT return)

2. The minister did not bow to the demand of industry to withdraw the Fringe Benefit Tax but he modified it to remove some of the glitches in its implementation. Similarly, he ruled out withdrawal of Banking Cash Transaction Tax

Yahoo! Photos – NEW, now offering a quality print service from just 8p a photo.

Monday, February 20, 2006

Finance | Tax | Save while the going's good-d day is near

Save While The Going’s Good

The D-day is only a few weeks away. Arnav Pandya examines your chances of saving your hard-earned money in these taxing times

Publication:Economic Times Bangalore; Date:Feb 20, 2006; Section:ET Big Bucks; Page Number:17

IT’S the last couple of months of the financial year and the countdown has begun. These months are taxing for most people as the scramble for making the requisite tax-saving investments reaches a climax. With each passing day, investors get pushed into a corner and in many cases end up making investments that are not the optimum or the best choice for them. ET Big Buckstakes a look at the situation with some guidance on how to go about this process.

The first thing that investors need to know is that each day is precious and hence, the earlier one starts the lesser the load will be at a later stage. The first step is to determine the total amount of such investment. One can divide the tax saving investments into two broad categories. One category includes the investments under Section 80C and Section 80CCC where the combined limit stands at Rs 1 lakh for the financial year ’05-06 while the second consists of other deductions like payment of medical insurance premium, donations etc.

The benefit of making the necessary investments is that of deduction from the taxable income. Now, with rebates being abolished from the tax provision, most of the benefits that are present are through the feature of deductions. Under a deduction, the amount of the benefit is reduced from the income to arrive at the taxable income and then the tax is calculated on the remaining part of the income. For example, if the income of an individual is Rs 3.4 lakh and there is deduction of Rs 90,000 that one is eligible for, then the taxable income comes to Rs 2.5 lakh on which the tax will be calculated.

The tax saving investment process also has to be brought in line with the overall financial planning for an individual because this part can also fulfil some of the objectives of the overall financial plan. First, consider the overall deduction of Rs 1 lakh. At this stage of the financial year, the individual can use the process of backward calculation to arrive at the figure that still needs to be invested.

Before other things, one has to look at the investment that is already made. For example, for a salaried employee there will be a contribution to provident fund, which is a compulsory deduction made each month from the salary paid. Another common investment many people make is the payment made each year as insurance premium or the tuition fees paid for children.

Many people run up quite a sum through such fixed payments and this makes the job of making the remaining investments a bit easier. The next decision to be made is whether the remaining portion of the investment required to finish the limit of Rs 1 lakh should go into debt, balanced or equity.

For those who are conservative and would not like to take much risk, the debt option is the route to follow. The age factor as well as the risk-taking ability will come into play here. Taking a bit of due diligence even within this can help an investor gain a bit. Lock-in period of the funds and the stability of returns along with the post-tax return figure are important factors to consider. For example, if one wants a steady earning rate, then the National Savings Certificate, which gives an 8% compounded semi-annually, will be a good option. However, in this case there is no payout and the individual will be able to get the return amount figure only at the time of maturity. On the other hand, the public provident fund scheme (PPF) will give a return of 8%, which is tax free and thus boosts the post-tax return figure. But there is no guarantee on the rate remaining at this level as it can change anytime in the interim period and from that date onwards the entire amount will be charged at the new rate. However, for most investors till the time PPF moves under the new exempt, exempt, tax (EET) system completing the maximum amount of Rs 70,000 allowed would be a preferable choice.

If one would like to go in for a slight element of risk then the hybrid option of pension schemes floated by mutual funds are a good choice. On the traditional front of insurance, one can select a policy only because the insurance is required and not because there is an investment to be made. Insurance companies are still strongly pushing unit-linked products, but investors need to make their own calculations to see whether these schemes suit them.

Finally, there is also an equity choice in the form of equity-linked savings schemes (ELSS) floated by mutual funds. These schemes invest their corpus in equity shares and there is a lock in of three years for investors. These are hot selling products at the moment because of the bull run in the markets and those who have put in money in the last three years in such schemes have seen very good returns. Anyone looking to invest in such schemes needs to know that there is chance of capital erosion in this area if the market and consequently the portfolio of the scheme show a negative performance.

Another point to note while investing in equities is that the investment should be regular and spread out so that there is not much risk concentrated in a single product. With just more than a month remaining in the financial year this might not be possible and hence investors might have to make do with just a couple of investments in the current financial year. This is a factor that one must consider while putting sums at this stage in ELSS schemes.

Apart from the basic Rs 1 lakh limit there are some other benefits that can be availed by individuals. Amounts paid as medical insurance premium up to Rs 10,000 in a year are allowed as a deduction for an individual and such coverage is a useful, if not a compulsory investment for people who are not covered for medical emergencies. Repayment of principal in education loans is also allowed as a deduction for individuals.

Another area where several people get a deduction and a benefit is by donations to specific institutions and trusts. These donations are eligible for a deduction at a certain percentage depending upon the institution to which the amount is donated.

Tuesday, January 17, 2006

Hot news| Finance | Stock Market | Reliance Demerger-Price fixed at 714.90

Hello people,

The demerger of Reliance Industries {referred here-after as RIL} has finally taken place.The final price of Reliance Industries (details at http://economictimes.indiatimes.com/currentquote.cms?ticker=ril&ticker1=Searching&exchange=B&Submit=Go%20target= ) stock has been fixed at 714.90 after the special trading session that was conducted between 8-9 am today, taking it down by 23% from yesterday's close of 928.15 (which was 55.05 higher from Monday's close of 873.10).

To understand this better, following is what is going on...and what are the implications

1. Each RIL shareholder will get 5 shares for each share he holds in the ratio specified by the company.

In stock market terms, each RIL shareholder will get one share of Reliance Energy Ventures, Reliance Capital Ventures with a face value of Rs 10 each and Reliance Communication Ventures and Global Fuel Management Services with a face value of Rs 5 each.

Here, taking an example of a share purchased for Rs 890 to see how this has to be split.

The main Reliance share will have a cost price of 52per cent of the total which, in this case, works out to Rs 462.8. The share of Reliance Communication Ventures will be valued at Rs 344.4 (38.7per cent), Reliance Energy Ventures Rs 64.9 (7.3per cent), Reliance Capital Ventures and Reliance Natural Resources shares will cost Rs 11.5 (1.3per cent) and Rs 6.2 (0.7per cent), respectively.

2. This meant that whoever has a share of RIL is in profit. No doubt, as expected, the demerged share has been taken to trade at a lower price, but still the extra shares that one gets, put him still in profitable position. RIL has been seeing news in the stock markets taking the SENSEX to a swing, moving from high to low. Day before yesterday the stock went down to 873.10 and then yesterday to a high of 937.5 before closing at 928.15 (though market closed flat at +2.94). It made news by being the stock to be the traded in largest volumes.

Reason : Investors who bought a Reliance share on January 17 will be eligible for the four additional shares. This benefit won’t extend to investors if they buy the share on January 18.

3. Tax Implication : Since the demerged share is expected to trade at a lower price, the question that many have is whether the resulting difference would be considered as a short-term capital loss.

Expectation : Market price of RIL to go even higher today.

Reason: The original shareholder would still get the shares of the holding company even if he sells his RIL share on or after 18th.

....................

Just wanted to share this great piece of news which is making waves everywhere and is surely going to affect the Indian economy.

For more news check Google news at :

http://news.google.com/news?hl=en&lr=&rls=GGLM%2CGGLM%3A2005-52%2CGGLM%3Aen&tab=nn&ie=UTF-8&q=RIL+demerger&btnG=Search+News

Articles used as input :

RIL demerger: What goes where {Times News Network} :

Buying RIL share: Know its tax implications {Times News Network} :

Regards

Kanuj

For more posts on finance, market, or tax please check the blogs :

My finance : http://financially-strong.blogspot.com/

My market : http://marketty-strong.blogspot.com/

My tax : http://taxably-strong.blogspot.com/

Disclaimer : This article contain personnal views expressed by the author with inputs from news articles and have no legal validation.

Tuesday, December 27, 2005

Finance | Tax | PAN

What is PAN?

Getting the new PAN card

Application for PAN should be made in prescribed form (Form 49A) and submitted in any of the I-T PAN Service Centres set up and managed by UTIISL across the country.

I-T PAN Service Centres

From July 1, 2003, I-T PAN Service Centres have been set up in all cities or towns where I-T offices are located.

For further convenience of PAN applicants in major cities there will be more than one I-T PAN Service Centre.

Location and other details about I-T PAN Service Centres in any city can be obtained from local Income Tax Office or offices of UTI or UTIISL in that city or from Web site of the Income Tax department (http://http://www.incometaxindia.gov.in/) or of UTIISL (http://www.utiisl.co.in/).

These I-T PAN Service Centres shall supply and receive PAN applications on behalf of all Assessing Officers, assist PAN applicants to correctly fill up the applications, check documents to be submitted as proof of 'identity' and 'address' by the applicant and issue acknowledgment for correct and complete applications

Read More at http://www.rediff.com/money/2003/jul/11pan.htm

Remember PAN is required for transactions at various institutions, eg. for a deposit of Rs 50K and above cash, you have to give your PAN number, your credit card companies (atleast HSBC does) will ask you for PAN, your demat/share broker will ask you for a PAN.

To help you stay safe and secure online, we've developed the all new Yahoo! Security Centre.